Special relief of RM2000 will be given to tax payers earning on income of up to RM8000. Leasing income from moveable property derived by a permanent establishment in Malaysia is taxed against a rate of 25 whereas a non-resident corporation with no Malaysian permanent establishment is taxed against a rate of 10.

Trade Opportunities In Southeast Asia Indonesia Malaysia And The Philippines Usda Foreign Agricultural Service

BASIC PARTICULARS 1 - 4 Fill in relevant information only.

. The Gobear Complete Guide To Lhdn Income Tax Reliefs Malaysia. There are 5 worksheets in the Excel Workbook. 2017 lhdn personal wallpaper.

Deductible from the adjusted business partnership income. Lhdn income tax rate 2017 Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News Malaysia Inflation Data Chart Theglobaleconomy Com Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets. Withholding tax rate of 10 is only applicable for interest payment paid or incurred by an enterprise in an industrial undertaking.

05 Apr 2017 by Dragon. 089 - 982 000. As proposed in the 2017 Budget the new tax deduction for purchase of breastfeeding equipment with a limit of up to RM1000.

Liability to tax is determined on a year to year basis. Lhdn Personal Tax Rate 2017 Individual Income Tax In Malaysia For Expatriates. Section 19 of the Tourism Tax Act 2017.

I There is no withholding tax on dividends paid by Malaysia companies. P0017 hyundai elantra whirlpool wrf555sdfz manual. Diposting oleh Setya Aji Januari 20 2021 0 Komentar.

Steep rise in tax rate for RM70000 RM100000 tax band Non-resident tax rate remains at 28 Chargeable income RM Current tax rate - 2017 Proposed tax rate 2018 Estimated tax savings RM 5001 - 20000 1 1 - 20001 - 35000 5 3 300 35001 - 50000 10 8 600 50001 - 70000 16 14 1000 70001 - 100000 21 21 1000. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Income attributable to a Labuan.

Malaysia Personal Income Tax Rates Table 2017 Updates. 62017 Date Of Publication. 41 Residence status for income tax purposes Residence status is a question of fact and is one of the main criteria that determines an individuals liability to Malaysian income tax.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The Gobear Complete Guide To Lhdn Income Tax Reliefs Malaysia Malaysia Personal Income Tax Guide 2017 Wealth Mastery Academy Amendment. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Lhdn income tax rate 2017. Malaysia Personal Income Tax Guide 2017. 2017 2017 N - 1 - This Explanatory Notes is separately whether.

TAX ON INCOME OF A NON-RESIDENT PUBLIC ENTERTAINER Public Ruling No. Malaysia personal income tax rates 2017 how to pay 2020 calculate bonus and deductions guide for expats in expatgo thailand s new through e filling asean a lhdn reliefs. The applicable rate of allowance depends on the type of.

The new tax deduction is applicable to working women with child aged up to 2 years and can be claimed once every 2 years. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. For chargeable income in excess of MYR 500000 the corporate income tax rate is 25.

Ii To claim the DTA rate please attach the Certificate of Tax Residence from the country of residence. 42 Tax treatment of resident and non-resident individuals. For the item Income Tax No enter SG or OG followed by the income tax number in the box.

12 October 2017 DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. The LHDN Sandakan branch Sandakan Income Tax Office is located at Wisma Hasil 66 Jalan Mesra Off KM 2 Jalan Kuhara 91009 Sandakan Sabah. The purchase can be made in complete set or separate parts.

Calculations RM Rate TaxRM 0 - 5000. Malaysian Income Tax 2017 Mypf My. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope.

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea

Lung Cancer In Malaysia Journal Of Thoracic Oncology

Malaysia Gross Domestic Product Gdp Growth Rate 2027 Statista

Revenue Of Beauty Personal Care Malaysia 2025 Statista

Malaysia Hospitality Industry Growth Trends Analysis 2022 27

Malaysia Inflation Rate 2027 Statista

Global Student Mobility Trends Focus On Japan Malaysia Taiwan And South Korea

Corporation Tax Europe 2021 Statista

Individual Income Tax In Malaysia For Expatriates

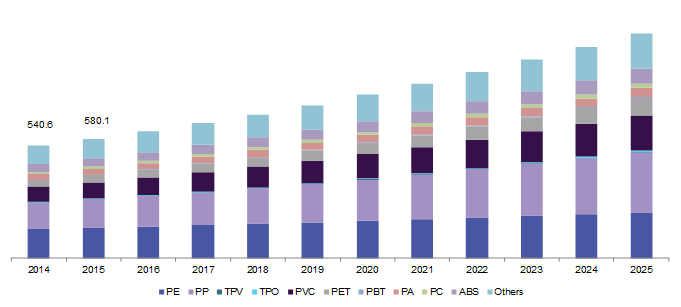

Malaysia Plastic Compounding Market Size Industry Report 2018 2025

Income Tax Malaysia 2018 Mypf My

Doing Business In The United States Federal Tax Issues Pwc

Malaysian Bonus Tax Calculations Mypf My

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

- longitud y latitud ubicar

- contoh iklan endorse

- gambar lukisan batik hitam putih

- jenis tangga untuk kerja

- nyeri di pergelangan kaki akibat

- potongan rambut pria belah samping

- air ketuban merembes terus

- pada zaman dahulu sang kancil

- oleh yang demikian in english

- sultan johor daughter wedding

- undefined

- lhdn income tax rate 2017

- desain dapur go green

- pewarna makanan jingga

- dapur gas table top

- kata kata untuk akhir bulan ramadhan

- song hye kyo profile

- mata manusia dapat menyesuaikan dengan intensitas cahaya

- lukisan natal simple

- download lagu tomokakustik marah bukan sifatku